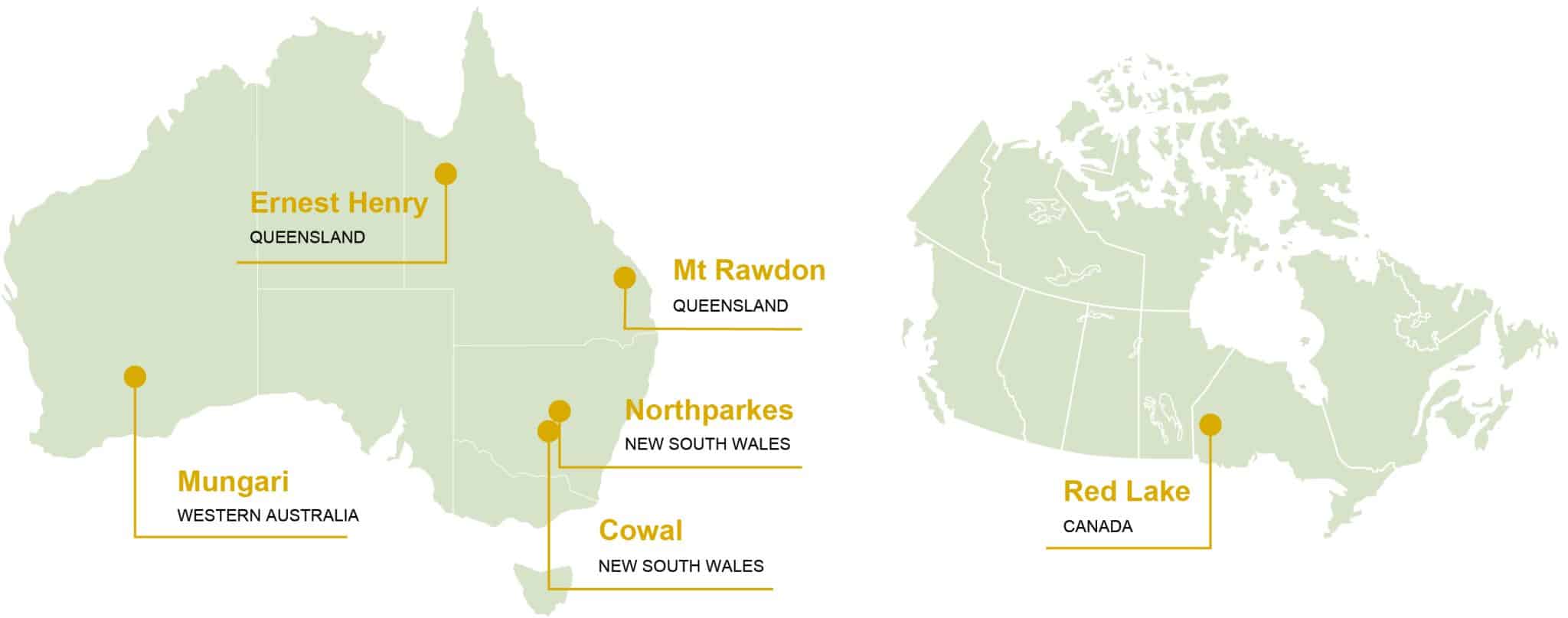

Our Assets

Australia

Cowal

New South Wales

Cowal

The Cowal gold operation is a world-class, open pit gold operation located 350km west of Sydney.

Find Out More

Mt. Rawdon

Queensland

Mt. Rawdon

The Mt. Rawdon open pit gold operation is located 75km south-west of Bundaberg, Queensland.

Find Out More

Mungari

Western Australia

Mungari

The Mungari gold operation is located 600km east of Perth and 20km west of Kalgoorlie, Western Australia.

Find Out More

Ernest Henry

Queensland

Ernest Henry

The Ernest Henry copper-gold operation is a large-scale, long-life asset located 38km north-east of Cloncurry, Queensland.

Find Out More

Northparkes

New South Wales

Northparkes

Northparkes Operations is a copper-gold mine located 27 kilometres north-west of Parkes in Central West New South Wales.

Find Out More

Canada

Red Lake

Canada

Evolution Mining is a leading, globally relevant gold miner. Evolution currently operates six mines, being five wholly-owned mines – Cowal in New South Wales, Ernest Henry and Mt Rawdon in Queensland, Mungari in Western Australia, and Red Lake in Ontario, Canada, and an 80% share of Northparkes in New South Wales.

FY23 Highlights

In FY23 we produced 651,155 ounces of gold at an AISC of A$1,450 per ounce – among the lowest cost gold producers in the world.

651koz

Gold Produced

A$1,450/ OZ

AISC

A$164M

statutory net profit after tax

~A$2.5B

contribution to the Australian and Canadian economies

Payout of

~A$92M

dividends paid

Mineral Resources

30.3Moz gold

1.8Mt contained copper

Ore Reserves

10.0Moz gold

Contained gold 4% decrease

A$944M

Operating mine cash flow