Management Approach

Access to safe, clean water, and sanitation is a basic human right and supports healthy ecosystems and livelihoods. We acknowledge water as a shared resource, and recognise its globally recognised social, cultural, environmental, ecological and economic value that drives

improved water management stewardship. Our strategic water management approach is centred on efficiently managing water, water-related risks, and climate-related risks to secure availability and sustainability of clean water for all, such that human health and the environment are protected, and operations are sustainable in a variable water security environment.

The CEO is accountable for our water and environment with Management responsible for the performance, with oversight of the Board through the Risk and Sustainability Committee.

Our water strategy and objectives are informed by robust engagement with stakeholders such as investors, policymakers, non-government organisations and communities. Through stakeholder engagement, we understand, assess, track and monitor water regulatory changes at the local level, including incoming regulatory changes and different scenarios and impacts. Our strategy focusses on optimising water consumption, reducing reliance on fresh water, maximising reuse of mine affected water (MAW) to reduce competition in external raw water demand with agricultural and other industries and communities, and minimising the potential for operational impacts on water quality. We aim to minimise operational water consumption, effectively and efficiently use water in our processes, and ensure that

any effluents are treated to meet required water quality standards.

Each operation maintains Water Management Plans and site-wide water balances to guide responsible water use throughout the mine lifecycle and in the context of the local catchment. Water-related activities are regulated by relevant legislation in each jurisdiction and are

subject to set quality and quantity thresholds.

Performance

In FY23, our Queensland operations experienced significant rainfall which impacted the Ernest Henry and Mt Rawdon operations. Our Critical Risk Management processes are implemented across the assets and water impacts were managed with no harm identified in the receiving environment.

Total water withdrawn decreased 6.2% in FY23 and water security improved by a decrease in freshwater demand intensity of 17% in FY23 (0.19kL/tonne ore milled) – a significant improvement of 44% compared to FY20 baseline.

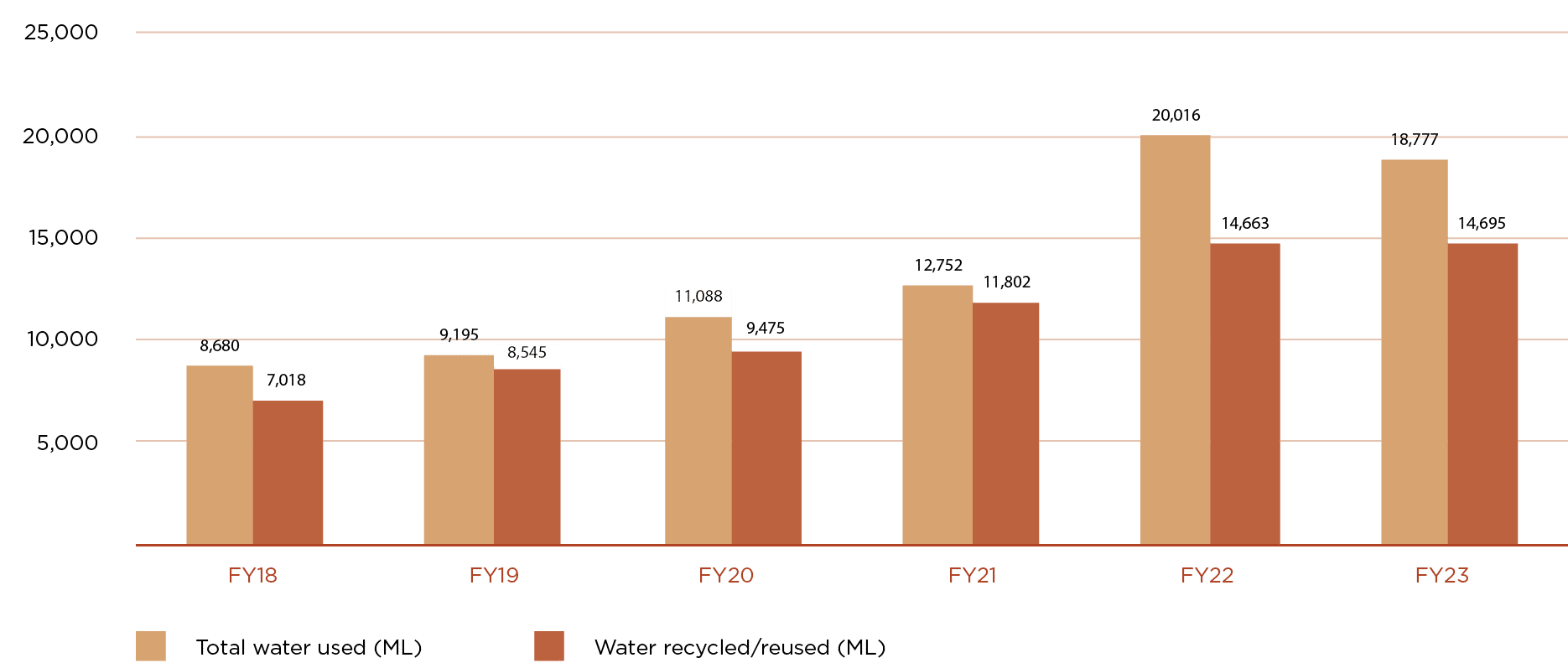

Total water reuse increased by 7% between FY22 and FY23. Notable increases in water reuse were recorded at Cowal (33%) and Mt Rawdon (100%), demonstrating the increased focus and planning associated with water reuse at all operations.

No Evolution operations are in High to Extremely High baseline water stress areas. Evolution’s determination of water stress is adapted from definitions set in the ICMM Mining with Principles Water Reporting52, CEO Water Mandate, WRI Aqueduct Global Water Tool and Water Footprint Network.

Water Reuse FY18-FY23

Detailed information on our water withdrawal, discharge and consumption by source and region can be found in the ESG Performance Data.

In FY23, the total water withdrawn intensity per tonne of ore processed decreased by 1% from FY22. The decrease is attributed to the decrease in overall freshwater intake at Cowal, Mt Rawdon and Red Lake operations.

Our future efforts in water management will include continued focus on water security, including the mitigation of the effects of extreme weather events (drought and flood) through a reduction of total water demand, increase in water reuse, water storage and stormwater, sediment and erosion control best practice controls.