Rehabilitation and Closure Management

Management Approach

The objective of our mine closure plans is to ensure that the environment where mining activities take place is restored to a long-term sustainable state, which may be a similar condition to what existed before mining took place, or a condition suitable for another use, in line with relevant stakeholder engagement outcomes. We have obligations to make operational and financial provisions to ensure the mine closure plans, rehabilitation and remediation activities are completed with consideration for internal and external stakeholder engagement.

Closure planning is undertaken for all operations, and financial provisions updated as required. We plan for closure from the earliest stages in the life of mines, including consideration at feasibility stage prior to mine development, ensuring appropriate due diligence, impact assessments, and allocation of adequate resources for closure activities to be properly implemented, managed and monitored throughout the active-closure and post-closure phases.

The Rehabilitation and Mine Closure Sustainability Performance Standard requires the use of a responsible approach to land management through the operational phase and into closure, including progressive rehabilitation during the life of mine. Closure planning requires site-specific closure objectives, metrics and targets, and completion criteria for each operation. Closure plans are required to be developed to a level of detail that reflects the stage of each mine’s life cycle, and they are updated in accordance with the Standard and regulatory requirements reflecting operational changes and progressive rehabilitation requirements.

Progress reports on implementation and compliance with ongoing reclamation commitments are submitted to regulatory authorities as required and third-party auditors annually.

Performance

- Enhanced stakeholder engagement integrated into the planning phase

- 7,056 hectares of land disturbed by mining activity

- 1,109 hectares of land rehabilitated

- Closure Plans in place for all operational sites

- Annual Mine Closure Assurance Audit and Mine Closure Insurance Audit (LOD3)

- Rehabilitation sites revegetation success rates monitored closely

- Ongoing wetlands trial at Mt Rawdon to support rehabilitation objectives and ecosystem protection

- Ongoing extensive reclamation activities at Red Lake in the treatment of legacy Arsenic Trioxide materials from underground

workings - Significant milestones being completed for the Mt Rawdon Pumped Hydro Project, including ‘Coordinated Project’ Status, hosting Community Information Evenings with approximately 70 attendees, and running tours of the operation with roughly 150 participants. Read a detailed case study here, and access more information about the project here: https://mtrawdonhydro.com.au/

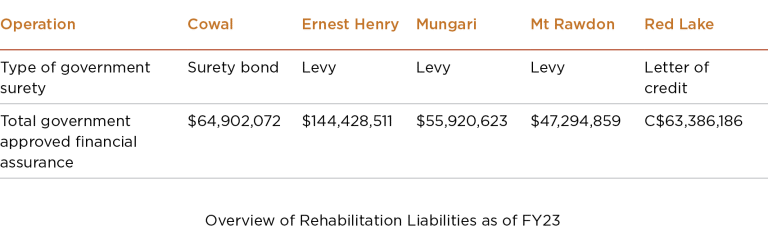

• ~$384 million55 government-registered rehabilitation liability – 30 June 2023 (refer to table below)

Red Lake’s rehabilitation liability converted from Canadian to Australian dollars using exchange rate as at 30 June 2023