Net Zero Commitment

For our planet and our future there is growing commitment amongst world nations and businesses towards a Net Zero future. There is also an increasing expectation from all stakeholders, that action with a positive impact on achieving a Net Zero future, is implemented. This is a future state where there “is no incremental addition of greenhouse gases into the atmosphere” (Net Zero definition – Intergovernmental Panel on Climate Change, IPCC).

Evolution supports the Paris Agreement and in FY21 announced a commitment to be Net Zero by 2050 (Scope 1 and 2 emissions only) and an interim target of reducing our emissions by 30% by 2030 (against a FY20 baseline). In the development of Net Zero targets, it is recognised that the current asset portfolio may change over time. However, our commitment to sustainability will continue throughout the life of the Company, making Net Zero relevant, including for the communities in which we operate.

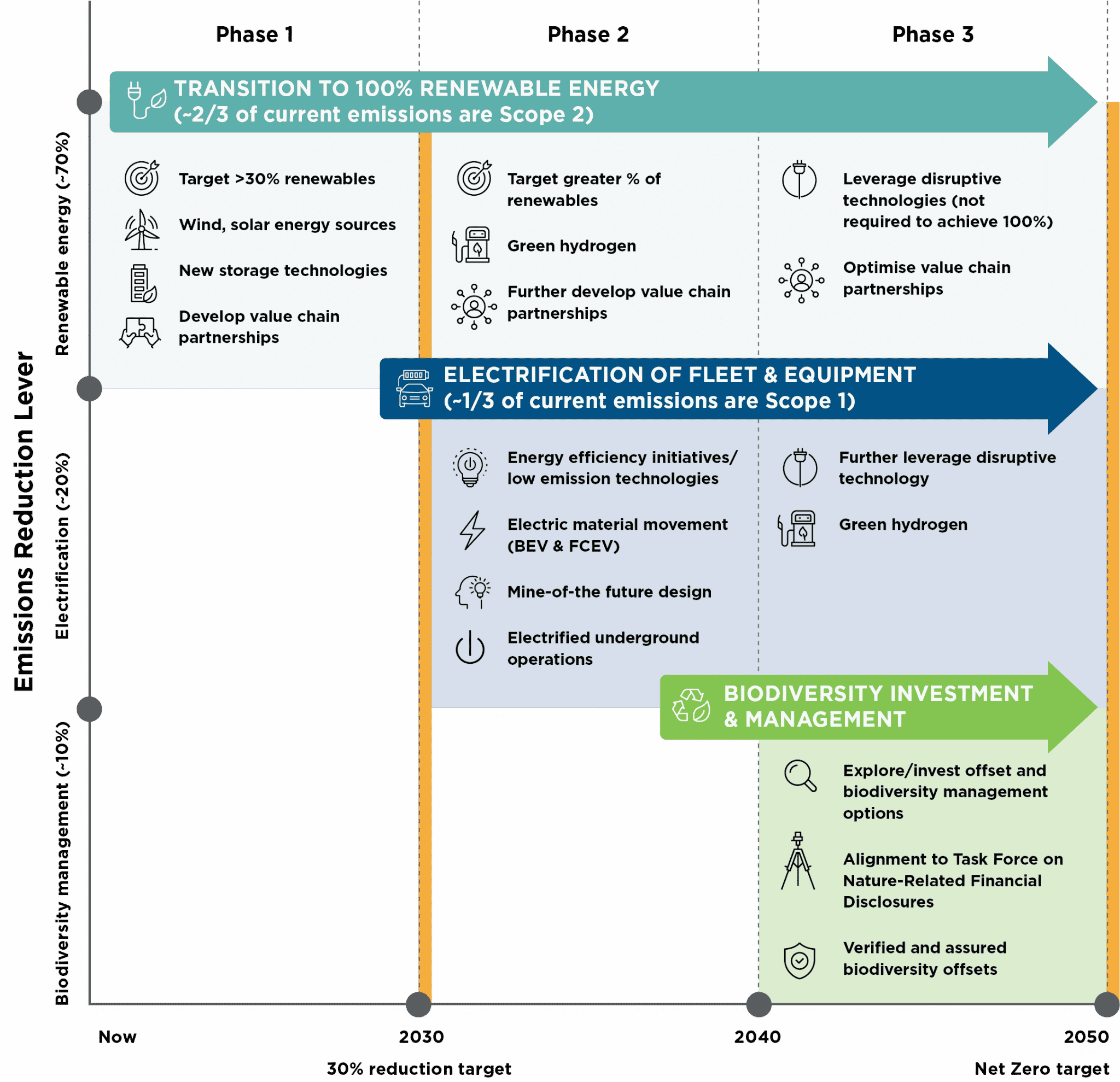

This commitment recognised that climate change is one of the most pressing problems facing all of us and that we need to take serious action if we are to have a future business, clean and productive environment and healthy society. The figure below illustrates the key levers and actions that will guide us on our pathway to achieving our Net Zero commitment. The key levers are:

1. Transition to renewables

- Development of renewable solutions such as pumped hydro at Mt Rawdon

- 2/3 of our emissions are Scope 2

2. Investment in low-emissions technologies

- Transition to electric fleet or gaseous based fleet

- Driven by industry and other key partners incl. government, industry associations, community groups etc

- 1/3 of our emissions are Scope 1

3. Biodiversity investment and management

- Changing value of our ecosystems including nature, biodiversity and rehabilitation (linked to Task Force on Nature Related Financial Disclosures)

OUR TARGETS

30% reduction by 2030

Net Zero emissions by 2050

Why Net Zero?

Context

To ensure long term stakeholder value is delivered, Evolution is building climate related risk resilience in our operations and our communities.

The current asset portfolio at Evolution may change over time. However, Evolution’s commitment to sustainability will continue throughout the life of the company, making “Net Zero” relevant.

Scope 2 emissions was the most significant portion of Evolution’s emissions. Therefore, focusing on renewable energy sources will deliver the greatest impact on emissions reduction over the short to mid-term.

Technology transition and mobile fleet replacement pose key barriers to more significant reductions in Scope 1 and planning for the long-term transitional change has commenced.

Paris-aligned; GHG Protocol’s location-based or market based emission factors should be used to measure annual

energy use.

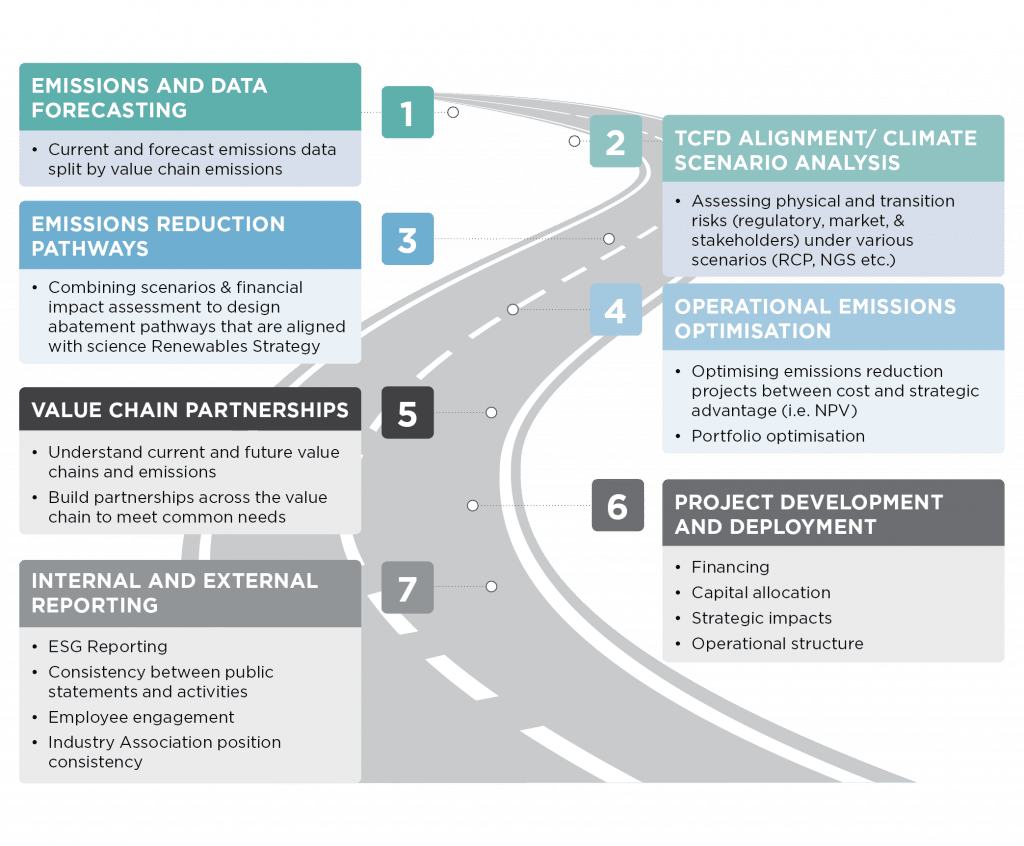

Conceptual pathway to Net Zero commitment

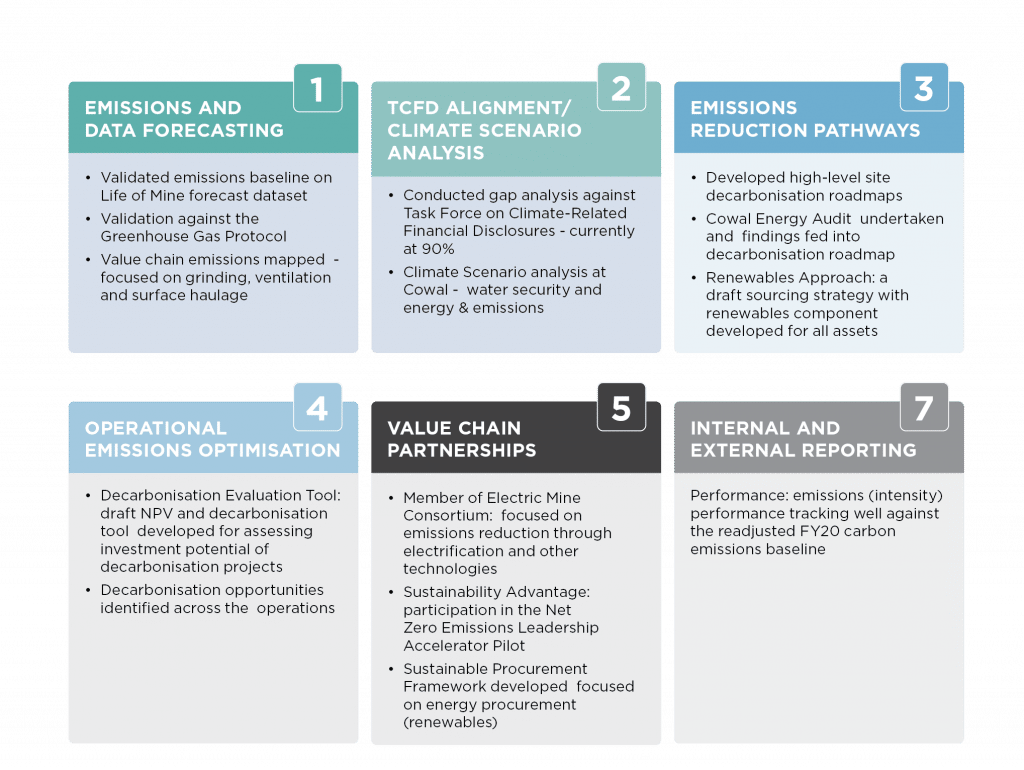

The key pillars of work that shape our approach to achieving our Net Zero commitment are presented in the figure below:

Evolution’s approach to Net Zero

In FY22, our mitigation and adaptation strategies to climate-related risks were further strengthened including mapping our value chain emissions to better understand emissions-intensive activities; integrating climate change measures into strategic planning; increased focus on value chain partnerships; and continued education and awareness-raising on our Net Zero approach and performance.

To align with climate science and the curbing of climate change aligned with the Paris Agreement targets, additional validation of the decarbonisation roadmap was completed. In the medium-term, this will focus primarily on the energy value chain, with a reduction in reliance on fossil fuels, moving to electricity generated by renewables. The longer-term focus will be on storage and ways to replace diesel fuel in mobile fleets.

We have also established a dedicated Net Zero Project as part of the FY23 Balanced Business Plan, which will build upon progress made in FY22. It will continue to embed our commitment to Net Zero into the capital investment process as well as the business planning and operational delivery processes.

Progress made in FY22 toward achieving our Net Zero commitment is summarised in the figure below: